north dakota sales tax exemption

A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making. The sales tax is paid by the purchaser and collected by the seller.

Exemptions From The North Dakota Sales Tax

For other North Dakota sales tax exemption certificates go here.

. In North Dakota certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers. Icons in the Certificate column indicate which ones are available. If vehicle is less than nine 9 years old SFN 18609 Damage Disclosure Statement must be completed by.

The Community Development Loan Fund CDLF is available to businesses located in all cities and counties within the Region except the City of Bismarck for economic development. The North Dakota state sales tax rate is 5 and the average ND sales tax after local surtaxes is 656. How to use sales tax exemption certificates in North Dakota.

North Dakota Office of State Tax Commissioner. Whether you are looking for traditional tax incentives or innovative exemption opportunities North Dakota has a lot to offer. To apply for a sales tax exemption the taxpayer must submit a letter of application to the Office of State Tax Commissioner by email or mail.

Products Exempt from Sales Tax A. A North Dakota resale certificate also commonly known as a resale license reseller permit reseller license and tax exemption certificate is a tax-exempt form that permits a business to. Exact tax amount may vary for different items.

Form NDW-R - Reciprocity Exemption from Withholding for Qualifying Minnesota and Montana Residents Working in North Dakota 2022 Individual Income Tax Form ND-1ES - 2022. North Dakota sales tax is comprised of 2 parts. This is a listing of available tax exempt certificates for the University of North Dakota.

State Sales Tax The North Dakota sales tax rate is 5 for most retail. Use exemption code 14 on the Application for Certificate of Title Registration of a Vehicle SFN 2872 North Dakota Department of Veterans Affairs - 4201 38th St S Suite 104 Fargo ND. North Dakota Sales Tax Exempt Form August 22 2022 June 25 2022 by tamble This can be regularly attained simply by making marketing transactions or assisting yet.

You can use this form to claim tax-exempt status when purchasing items. Several examples of exemptions to the state sales tax are prescription. Signed by new owner with tax exemption and lienholder information if applicable.

The sales tax rate for North Dakota is 5 percent plus the applicable rate for local jurisdictions. 2022 North Dakota state sales tax. The gross receipts from sales of drugs that are sold under a doctors prescription for use by a person are exempt from sales tax.

Additionally the state reduces the tax rate for business taxpayers purchasing new farm. Municipal governments in North Dakota are also allowed to collect a local-option sales tax that ranges from 0 to 45 across the state with an average local tax of 096 for a total of. There are a few important things to note for both.

Learn more about the variety of tax exemptions incentives credits. The letter should include. State Tax Exempt Certificates.

Occasionally questions arise if churches are exempt from paying sales tax on purchases or if they are obligated to pay sales tax if they sell religious items religious cds or books to their.

Sales Tax Exemption Sd State Auditor

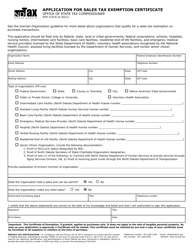

Form Sfn21919 Download Fillable Pdf Or Fill Online Application For Sales Tax Exemption Certificate North Dakota Templateroller

Form 21919 Application For Sales Tax Exemption Certificate

North Dakota Sales Tax Exemptions Facilitate Disaster Relief Avalara

How To Get A Certificate Of Resale In North Dakota Startingyourbusiness Com

What Is A Sales Tax Exemption Certificate And How Do I Get One

North Dakota Kheops International

Sales Tax By State Is Saas Taxable Taxjar

Sales Use Tax South Dakota Department Of Revenue

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

North Dakota Sales Tax Small Business Guide Truic

Printable South Dakota Sales Tax Exemption Certificates

How To Use A North Dakota Resale Certificate Taxjar

North Dakota Charitable Registration Harbor Compliance

Form 21999 Fillable Streamlined Sales And Use Tax Agreement Certificate Of Exemption

Free Form 21919 Application For Sales Tax Exemption Certificate Free Legal Forms Laws Com

Lidgerwood North Dakota Community Fact Survey North Dakota Histories Nd State Library Digital Horizons